“Crypto Buying Guide for Beginners: Navigating Security and Innovation”

As cryptocurrency continues to gain mainstream attention, more and more individuals are joining the ranks of early adopters. However, before diving into the world of buying and trading cryptocurrencies, it’s essential to understand the basics of crypto security and innovation.

In this article, we’ll break down the key concepts of crypto investing, focusing on two critical aspects: 2-factor authentication (2FA) and exchange listing.

What is 2FA?

Two-factor authentication is a security measure that requires users to provide not only their password but also a second form of verification, such as a fingerprint or voice command. This adds an extra layer of protection against unauthorized access to accounts, making it much more difficult for hackers to gain access.

In the context of cryptocurrency, 2FA is particularly important when trading online. Hackers can exploit vulnerabilities in wallets and exchanges, leading to significant financial losses. For example, if a user’s wallet is compromised, they may lose their entire holdings, including the cryptocurrencies they’ve purchased.

Why is 2FA essential for crypto investing?

- Protects against hacking: As mentioned earlier, hackers can use phishing or social engineering tactics to gain unauthorized access to accounts.

- Ensures secure transactions: 2FA ensures that users are required to provide their identity and proof of ownership before making a transaction.

- Reduces risk of loss: By requiring two forms of verification, 2FA reduces the likelihood of losses due to hacking or other malicious activities.

What is Exchange Listing?

Exchange listing refers to the process by which cryptocurrencies gain official recognition and legitimacy on established exchanges. This allows users to buy, sell, and trade cryptocurrencies without facing significant regulatory hurdles.

In recent years, more and more cryptocurrency exchanges have gone live, providing a platform for users to buy, sell, and trade various assets. However, the process of getting listed can be complex and time-consuming, involving several steps and approval processes.

How do I become an exchange listing candidate?

- Meet the regulatory requirements: Most exchanges require cryptocurrency listings to comply with relevant regulations.

- Apply for listing: Submit a proposal outlining your exchange’s vision, strategy, and operational plan.

- Pass KYC and AML checks: Complete Know Your Customer (KYC) and Anti-Money Laundering (AML) checks as part of the onboarding process.

Tips for buying crypto

- Diversify your portfolio: Spread your investments across different cryptocurrencies to minimize risk.

- Research and due diligence: Conduct thorough research on each cryptocurrency before making a purchase.

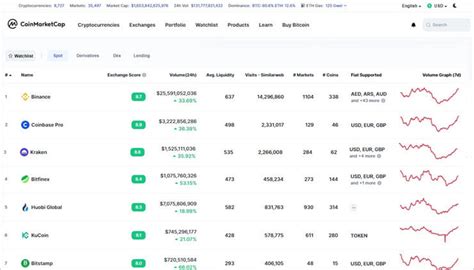

- Use reputable exchanges: Choose established, well-regulated exchanges that adhere to security standards.

- Set realistic expectations: Cryptocurrency prices can be highly volatile; be prepared for potential losses.

In conclusion, crypto investing requires a solid understanding of 2FA and exchange listing. By following these guidelines and taking the necessary precautions, you can minimize your risk and join the ranks of early adopters in this rapidly growing market. As cryptocurrency continues to innovate and evolve, it’s essential to stay informed and adaptable to ensure maximum returns on your investments.

Disclaimer: This article is not intended as investment advice. Cryptocurrency investing carries significant risks, and users should do their own research before making any decisions. Always exercise caution and consult with a financial advisor if needed.