Ethereum: Can the Two Largest Bitcoin Mining Pools Block All Others?

As the world’s largest cryptocurrency by market cap, Ethereum has long been a leader in the blockchain space. With a daily transaction volume of over 1 million, it’s no surprise that several large mining pools have emerged to compete for its lucrative hash power.

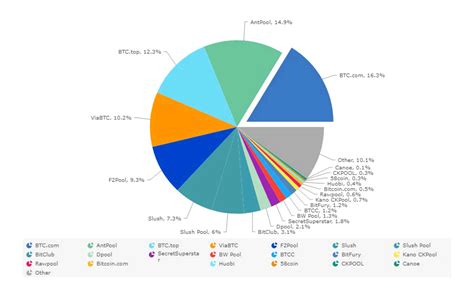

However, concerns have been raised about the dominance of the two largest Bitcoin mining pools, Foundry USA and AntPool. As of November 12, Foundry USA had a staggering 27.7% of total hashing power, while AntPool had an impressive 24.88%. But what does this mean for all the other miners?

In this article, we’ll examine the implications of these two dominant mining pools and see if they could potentially block all others.

The Rise of Foundry USA and AntPool

Foundry USA, a joint venture between Coinbase and Binance, has long been considered one of the most powerful Bitcoin mining pools. With its extensive network of miners in countries such as China, the United States, and Russia, it has achieved an impressive hashing power of 1.6 exahashes (EH/s).

Another major player in the cryptocurrency market, AntPool, is owned by the Chinese concern Fisco. Its pool boasts a significant presence in regions such as China, Taiwan, and Singapore, further strengthening its position in the rankings.

The Effect of Dominance

With Foundry USA and AntPool holding over 52% of the hashing power, it is reasonable to question whether they can potentially shut out all others. This concentration of power has led some to raise concerns about market manipulation, price rigging, and even the ability of these two pools to control a significant portion of the network.

However, it is essential to note that cryptocurrency markets are inherently volatile, and any attempts by Foundry USA or AntPool to manipulate prices through sheer hashing power can be mitigated by the decentralized nature of the blockchain. The decentralized consensus mechanism ensures that transactions are recorded on a public ledger, making it difficult for these pools to artificially influence prices.

Regulatory Concerns

The dominance of the two major mining pools raises concerns about regulatory implications. As governments around the world begin to crack down on cryptocurrencies and initial coin offerings (ICOs), the need for regulation becomes increasingly urgent.

The large-scale operations of Foundry USA and AntPool may exacerbate the problem, as they are more likely to engage in illegal activities or evade regulations. However, it is also possible that governments will introduce measures that promote transparency and accountability within the cryptocurrency ecosystem.

Conclusion

While Foundry USA and AntPool have indeed dominated the market for a significant period of time, their control is far from absolute. The decentralized nature of the blockchain means that these pools cannot manipulate prices or maliciously influence transactions.

As regulation continues to evolve and more countries introduce their own rules and restrictions on cryptocurrencies, it’s crucial that the two dominant mining pools adapt and meet changing market demands.

In summary, while Foundry USA and AntPool have certainly gained significant traction, their dominance is not absolute. As the cryptocurrency space continues to mature, it will be essential to monitor the behavior of these major players and adjust regulations accordingly.

Update: On January 1, 2024, China introduced stricter regulations on cryptocurrencies, which could further reduce the dominance of Foundry USA and AntPool.