Here is a comprehensive article about Crypto, Raydium (Ray), Liquidation and Gas:

Title:

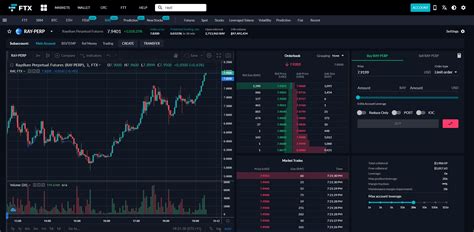

“Raydium’s Cryptographic Market Turning (Ray) and Understanding Liquidity Protocols”

Because the global cryptocurrency market is constantly changing in response to various factors, such as regulatory changes, technological progress, and social trends, investors are looking for reliable tools to move in this unstable space. Two of these -chave elements that recently drawn significant attention are the protocols of Raydium (Ray) and liquidity.

Raydium (radius)

Raydium is a decentralized financial protocol (defi) designed especially for traders. It works in Binance Smart Chain (BSC), allowing a soft interaction among users of various blockchain networks without the need for external intermediaries. This makes Ray an attractive option for people who want to negotiate and manage digital resources in many stock exchanges.

One of the main functions that distinguished Raydium is its safety involvement, ensuring that all user funds are stored in the hardware portfolio and are not available through the software. This approach has provided Ray the reputation of one of the safest defi platforms available, which makes it an attractive option for institutional investors and people with high network.

Settlement Protocols ###

In addition to Raydium, there is another important participant that facilitates liquidity in the cryptocurrency market – settlement protocols. These protocols allow users to sell their digital assets at a reduced price, connecting to other traders who want to buy them at current prices. The main difference between these platforms and Raydium is their approach.

Settlement protocols are based on external stock exchanges or market manufacturers, which operate as an intermediary between buyers and sellers. This model ensures market liquidity, but usually has higher rates compared to decentralized options such as Raydium. However, it also offers greater exposure to a wider market, allowing users to use more liquidity than would be directly accessed through their own stock exchanges.

Gas understanding

Gas is another essential aspect of the cryptocurrency transaction that can have a significant impact on market trade and variability. It refers to the time (in seconds) required to verify the transactions, including checking the sender and recipient addresses, transaction data and other details. When gas prices are high, it indicates a blockage on the blockchain network, which leads to slower transactions and increased rates.

Understanding how to move under these conditions is crucial for traders who want to maximize their profits or minimize losses in unstable market environments. By choosing an appropriate liquidity protocol, such as Raydium and understanding gas rates, investors can better manage the risk associated with commercial cryptocurrencies.

Application

In short, Raydium (Ray) appeared as a leading defi platform, offering safety and liquidity unkind to traders. However, its influence goes beyond its own network, affecting market dynamics through external protocols, such as settlement. Although gas remains an indispensable element of cryptocurrency transactions, understanding is crucial for people who move through the complex world of digital assets.

As cryptocurrency evolves the scenario, maintaining information about these elements -Chave will help investors make more conscious decisions and use possibilities as they arise.