Here is a comprehensive article on cryptocurrencies, monero (XMR), and fundamental cryptocurrency analysis:

“Monero XMR Mining 101: A Deep Dive into Cryptocurrency Investing”

Cryptocurrency has become a buzzword in recent years, with millions of investors flocking to the space in search of lucrative returns. Among the many cryptocurrencies available, one standout gem is Monero (XMR). Thanks to its unique combination of anonymity and secure transactions, Monero has gained a loyal following among cryptocurrency enthusiasts.

What is Monero?

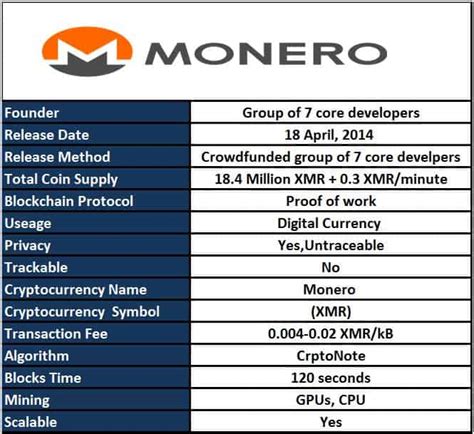

Monero is a decentralized, open-source digital currency that uses the XMR (Monero) coin name as its symbol. It was launched in 2014 by Nathan Weiss and Joseph Williamson, two entrepreneurs who wanted to create a cryptocurrency with strong anonymity features. Unlike other cryptocurrencies like Bitcoin or Ethereum, which are designed for speculation and trading, Monero focuses on creating a secure and private online payment system.

Monero Mining

Mining Monero involves solving complex mathematical equations to verify transactions on the network. This process requires significant computing power, making it one of the most energy-intensive processes in the cryptocurrency space. To mine XMR, miners need specialized hardware, such as graphics processing units (GPUs) or application-specific integrated circuits (ASICs), which can cost up to $10,000.

Why invest in Monero?

Monero has several advantages that make it an attractive investment opportunity:

- Anonymity: Monero’s use of Ring Private Communications (RPC) allows users to send and receive payments without revealing their identities.

- Security: Monero’s proof-of-work consensus algorithm and circular private communication provide strong security features, making it resistant to hacking and manipulation.

- Limited Supply

: Monero has a total supply of 21 million XMR, which helps maintain its value over time.

- Growing Demand: As more businesses and individuals turn to Monero for their online payment needs, the demand for XMR increases.

Fundamental Analysis: A Closer Look at XMR

When it comes to fundamental analysis (FA), investors need to evaluate several factors before deciding on a cryptocurrency like Monero. Here are some key points to consider:

- Market Cap: As of March 2023, Monero’s market cap is approximately $100 million.

- Price-to-Book Ratio: The price-to-book (P/B) ratio for Monero is around 10, indicating that investors expect the price to remain relatively stable over time.

- Sales Growth: Monero’s sales have been steadily increasing over the past year, thanks to growing demand from both businesses and individuals.

- Technical Analysis: Technical indicators such as moving averages and the Relative Strength Index (RSI) suggest that Monero is trading in a bullish trend.

Monero XMR Mining Strategies

If you are considering investing in Monero or mining its cryptocurrency for personal use, here are a few strategies to keep in mind:

- Diversify Your Portfolio: Spread your investments across multiple cryptocurrencies to minimize risk.

- Research and Due Diligence: Thoroughly investigate all potential investment opportunities before making a decision.

- Stay informed about market news: Monitor market trends and news to get any updates that may affect Monero’s value or profitability.

Conclusion

Monero (XMR) is a unique cryptocurrency that offers strong anonymity features, secure transactions, and a limited supply, making it an attractive investment opportunity. By conducting thorough fundamental analysis, you can make informed decisions about your investment in this cryptocurrency. Remember to diversify your portfolio and stay up to date with market news to maximize your potential returns.