Cryptocurrency Development: From coins to digital property management

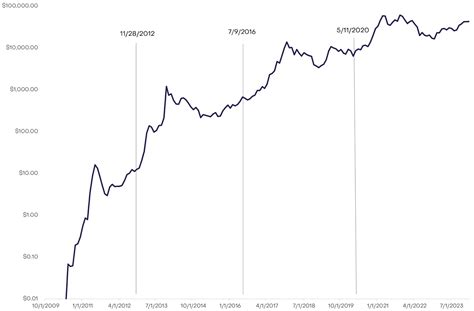

Over the past decade, cryptocurrency has experienced an extraordinary transformation from humble start as a digital currency into a full -fledged digital property management system. From an innovative experiment of decentralized finance (Defi) to widely accepted and regulated financial instruments, Bitcoin and other cryptocurrencies have evolved greatly on their journey.

Bitcoin birth

2009 An anonymous person or a group of persons using the pseudonym Satoshi Nakamoto created Bitcoin as an electronic cash system for peers. This innovative approach to the digital currency has been challenged by the traditional Fiat currencies by providing decentralized, safe and transparent exchange tools. The first Bitcoin block block known as Genesis Block was excavated in 2009. January 3

Early Year (2010-2014)

When more developers began to contribute to Bitcoin software, the project infrastructure expanded and new features were introduced. One noticeable development was the creation of decentralized exchanges (DEX) called Bitfinex in 2011, which allowed consumers to trade cryptocurrencies on an open network.

Early years have also emerged from other famous cryptocurrencies such as Litecoin (LTC), Ethereum (ETH) and Monero (XMR). These alternative projects have contributed to the growth of cryptocurrency ecosystem, providing new use, payment systems and decentralized programs (DAps).

Regulating check

When the value of Bitcoin and other cryptocurrencies began to increase, regulatory bodies around the world began to pay attention. 2013 June The Chinese government has banned the sale of most foreign currencies, including the trade in central banks, trying to curb speculation.

In response, governments implemented stricter cryptocurrency transaction regulations around the world, including the requirement for exchanges to register with the authorities and adhere to the Money Laundering (AML) Guidelines. This step marked a significant change from a more permissive approach taken in the early days of Bitcoin.

December of decentralized finance (Defi)

2016 Defi has become a separate category in the cryptocurrency space, the focus of lending, borrowing and trade platforms that use smart contracts and decentralized programs. The first Defi protocol, Mazedao Dai, was launched in 2017.

The case of use of Makerdao allowed consumers to pay funds to the DAO (decentralized autonomous organization) network, which subsequently allocated them to various projects through a token -based system. This innovative experiment showed the potential of Blockchain technology to facilitate lending and risk management on a decentralized scale.

The current state of cryptocurrency

Today, Bitcoin and other cryptocurrencies have become increasingly major: many institutional investors and financial institutions include their use. The emergence of new asset classes such as Stablecoins has further expanded the possibilities of the cryptocurrency market.

New Blockchain networks such as Polkadot (DOT) and SOLANA (SOL) are being developed to improve scaling, safety and convenience for a variety of use. In addition, Defi platform growth, including Uniswap (Uni) and Aave (Aave), facilitated individuals to participate in decentralized financial markets.

Digital Asset Management: Other Wall

Further change in cryptocurrency, its potential programs include not only speculation or investment goals. Digital property management (DAM) arises as a separate category that uses the strengths of cryptocurrencies to ensure transparent, safe and effective financial services.