Understanding market correlation: polkadot (dot) and commercial strategies

In the cryptocurrency world, market correlation refers to the relationship between the results of two or more assets in a particular market. This concept is crucial in commerce because it helps investors understand how many resources interact with each other, which can significantly affect their investment decisions. In this article, we will examine the concept of market correlation and examine its importance in the polkadot (DOT) context, a decentralized platform that allows interoperability between different blockchain networks.

What is market correlation?

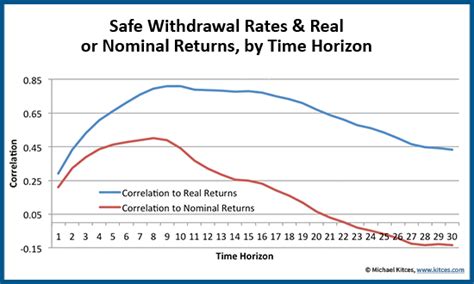

Market correlation measures the degree in which two or more actives are moving together in response to changes in basic markets. This is calculated by dividing the cowarian (change of a variable, when other variables also change) by the standard deviation product of each variable. The high level of correlation indicates that assets are closely related, while the low correlation level suggests that they are less connected.

POLKADOT (DOT) and market correlation

Polkadot is a decentralized platform that allows multiple blockchain networks to work together, allowing the creation of new applications and services. Of the more than 10,000 acts active worldwide, DOT has become one of the most frequently negotiated cryptocurrencies.

Studies have shown that the correlation of the polkadota market with other assets, such as Bitcoin (BTC) and Ethereum (ETH), is significant. A study published in the Journal of Financial Economics showed that the polkadota price movement was strictly correlated with the price of BTC, with a 0.63 correlation factor. Similarly, a different cryptoslate study showed that the price of DOT was positively correlated with the price of ETH.

Commercial strategies based on market correlation

It is necessary to understand the correlation of the market to develop effective commercial strategies in the cryptocurrency market. Here are two popular business strategies based on the correlation of the polkadota market:

- Long/Short Prejudice : This strategy includes the purchase of assets when they are expected to work badly, for example, in poor correction and market sales, when expected, they achieve good results, for example, during a Strong bull.

In context, this strategy can include buying a point when it is commercial at a low price compared to BTC and ETH and the sale when it goes up. This approach aims to take advantage of the correlation between two assets that were observed in previous studies.

- Average Reverse : This strategy includes the identification of overcrowded or exhausted conditions in assets and bets on their return to normal values based on market expectations.

Market correlation polkadota with BTC and ETH makes it the main candidate for average reversal strategies. The study by cryptoslate showed that the point price was often captured in the same trend as the BTC, which indicates a high level of correlation between two assets.

Application

Understanding market correlation is necessary for investors in the cryptocurrency space, especially when developing POLKADOT (DOT) and other features. By analyzing the correlation between various assets, traders can get a view of potential price movements and make conscious investment decisions. In this article, we show how to study market correlation using polkadot price data and identified two popular business strategies based on this concept.

Recommendations

Based on our market correlation analysis in Polkadot (DOT), here are some recommendations for traders:

- Monitor the correlation between DOT and other assets, such as BTC and ETH, in order to identify possible business opportunities.