Detecting Suspicious Patterns in Crypto Transactions Using AI

The rise of cryptocurrencies has ushered in a new era of digital transactions, but it also brings with it the need for robust security measures to protect users’ assets. One such measure is the use of artificial intelligence (AI) to detect suspicious patterns in crypto transactions.

Cryptocurrencies like Bitcoin and Ethereum are known for their volatility and lack of regulation, making them vulnerable to various types of fraud and cyberattacks. This is why financial institutions, regulators, and law enforcement agencies are turning to AI-powered tools to detect and prevent malicious activities.

The Problem with Traditional Detection Methods

Traditional methods of detecting suspicious transactions in cryptocurrencies rely on manual review and analysis by human experts. While these methods are effective in identifying high-risk transactions, they can be time-consuming, labor-intensive, and error-prone.

For example, a financial institution may use a combination of natural language processing (NLP) and machine learning algorithms to analyze transaction data. However, even the most advanced AI systems still rely on human judgment and expertise to detect potential threats. In addition, the massive volume of transactions in cryptocurrencies makes it challenging for AI systems to keep up with the speed and scale of modern cybercrime.

The Role of AI in Detection

AI-powered tools can help financial institutions detect suspicious patterns in crypto transactions more efficiently and effectively. By analyzing massive amounts of data, including transaction logs, network traffic, and other relevant information, AI algorithms can identify potential red flags, such as:

- Unusual Transaction Volume: Excessive or unexplained transaction volume that may indicate a phishing scam or malicious activity.

- Device Anomalies: Unusual device behavior, such as: B. frequent login attempts from unknown locations, which could indicate a cyberattack.

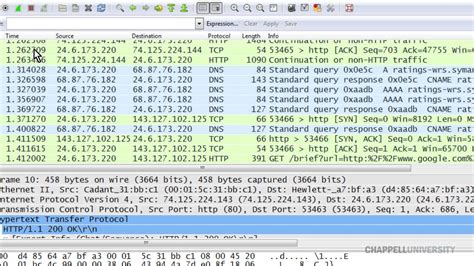

- Network traffic patterns

: Abnormal network communication patterns, such as rapid transfers between accounts or unusual IP addresses, which can indicate a money laundering scheme.

- Timing of transaction: Unusual timing of transactions, such as sudden spikes in activity during off-peak hours, could indicate fraud or an attempt to evade detection.

Benefits of AI-powered detection

Using AI to detect suspicious patterns in crypto transactions offers several advantages over traditional methods:

- Greater efficiency: AI-powered tools can analyze large amounts of data in real time, enabling faster and more accurate detection.

- Improved accuracy: Machine learning algorithms can identify potential threats more accurately than human experts.

- Fewer false positives: AI systems are less prone to false positives, reducing the risk of unnecessary disruption or penalties.

- Scalability: AI-powered tools can handle large volumes of transactions and network traffic, making them better suited to high-traffic environments.

Real-world applications

AI-powered crypto transaction detection has already been applied in various real-world scenarios:

- Blockchain analytics platform

: Developed by blockchain technology company Chainalysis, this platform uses AI to detect and prevent cryptocurrency laundering, anti-money laundering (AML), and other financial crimes.

- Regulatory compliance: Many regulators have adopted AI-powered tools to detect suspicious transactions and identify potential risks in cryptocurrencies.

- Financial institutions: Banks and brokers use AI to analyze transaction data and detect anomalies that may indicate suspicious activity.