The impact of market signals on cardano trade (ADA)

Cryptocurrencies appeared as a popular way to exchange value. Among them cardano (ADA), and decentralized blockchain project and cryptocurrencies, gained significant attention of both traders and investors. This article examined how market signals affect ada trade, emphasizing the importance of understanding these indicators in order to make informed investment decisions.

What are market signals?

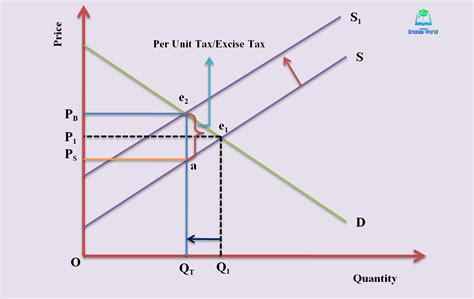

Market signals relate to various data points that provide insight into the results of assets or currency. They may include technical indicators, basic analysis and analysis of mood in social media. When Traders Analyze these market signals,

The impact of market signals on cardano (ADA)

Contractor, but this trend may change with the introduction of new market signals. During the analysis of these indicators, several key points appear:

* Technical Indicators: Relative Strength Indicator (RSI), Average Mobility of Convergence (MACD) and Stochasty Oscillator are some of the technical indicators used by traders to identify filled or sold -out conditions in cardano.

* Basic Analysis: Examination of Basic Cardano Indicators, such as Revenue Streams, Partnerships and Adoption Indicators, may provide valuable insight into the potential of assets.

* Sentiment of Social Media: Sentiment around Cardano on social media platforms such as Twitter and reddit, may indicate whether the market is optimistic or pessimistic in relation to assets.

Key Market Signals

In recent days there have been several key market signals that are worth considering:

* Increased trading volume:

* Rising Price:

* Reducing sentiment: Reducing the sentiment on social media platforms may indicate that investors become more cautious, which may be an indicating sales signal.

Trade Strategy

When considering Cardano Trade (ADA), it is necessary to connect market signals with other technical and basic analyzes. Here is a potential Commercial Strategy:

1.

- Set Stop Strategies: Stop-Strop Order Settings at key levels, such as 0.50 usd or 0.75 usd below current prices, to limit potential losses.

- Order: use a trade platform to perform transactions at the recommended input and exit points.

Application

Market signals play a key role in determining cardano (ADA) trade. Analyzing technical and fundamental indicators, traders can get a valuable insight into the results of assets and make informed investment decisions. The combination of these signals with other forms of analysis can help traders navigate the constantly changing landscape of cryptocurrency markets.

Additional Tips

- Always remember that earlier results do not guarantee future results.

- Market signals are not reliable and it is necessary

.

Understanding market signals and combining them with other forms of analysis, traders can make more conscious decisions regarding their investments in cardano (ADA).