Bitcoin: To own Bitcoin: makes it really rich or not?

I thought of this question for years without really understanding it. Let’s say that Bob has invested a small amount of money, an amount of about $ 100 dollars, in 2013, and now it would become about $ 1 million. Exactly, just over five years later, his initial investment has grown up to almost $ 1 million. But does this really mean what it means to have Bitcoin?

At first glance, it seems a safe thing. After all, Bitcoin is the most recognized and respected cryptocurrency in the world. It has a strong presence on the market and many people are anxious to enter the ground floor of this emerging sector. But while we will explore further, the truth is more complex.

Professionals:

- High yield potential:

Some people believe that Bitcoin has the potential to become a precious wealth shop, similar to gold or silver. If done correctly, investing in bitcoin could lead to significant yields on investments.

2

- Limited supply: Bitcoin’s total offer is limited to 21 million, which could lead to an increase in value over time.

i cons:

1 This volatility makes it difficult for investors to make sense of the market.

- Lack of regulation: The lack of regulation and supervision can lead to scams, phishing attacks and other types of financial abuse.

- Safety risks:

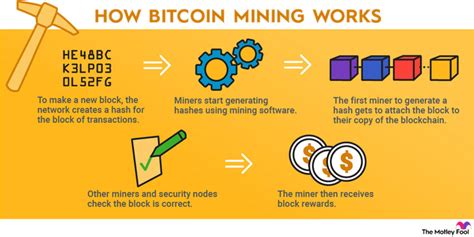

Bitcoin transactions are recorded on a public master book called Blockchain, which can be hacked or manipulated by harmful actors.

The truth:

Owning Bitcoin does not necessarily mean making one rich. While it is possible to create significant profits that invest in Bitcoin, it is essential to understand that the cryptocurrency market is highly volatile and subject to many risks.

In 2013, Bob invested $ 100 in Bitcoin at a time when around $ 1,000 was exchanged. In 2020, he would have been able to regain his initial investment for about $ 50 per bitcoin. Exactly, just over 10 years later, his investment has grown up to almost 6 times its original value.

However, this does not necessarily mean that having Bitcoin is a reliable way to make money. The market can run quickly and even the most successful investors have undergone significant losses.

key takeaways:

- The investment in Bitcoin should be done with caution: It is essential to do your research, understand the risks involved and never invest more than you can allow you to lose.

- diversification is the key: Don’t put all eggs in a basket. Diversify your investments to minimize risk.

- Understand the market: Before investing in bitcoin or in any other cryptocurrency, make sure you have a solid understanding of how it works and the risks involved.

In conclusion, the possession of Bitcoin can be a high risk proposal. While there are some benefits for investment in Bitcoin, including the potential for significant yields on investments, the risks involved cannot be ignored. Before making an investment decision, doing your search, understand the market and diversify your investments to minimize risk.