The Fintech border: unlocking the potential of cryptocurrency

As the world becomes more and more digital, cryptocurrency has become an important player in the financial panorama. With their rapid growth and growing adoption, it is not surprising that investors seek ways to capitalize on this trend.

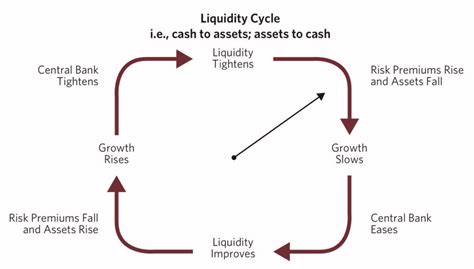

An aspect of cryptocurrency trade that has gained significant attention in recent years is liquidity. Liquidity refers to the ease with which an asset can be purchased or sell, without significantly affecting its price. In cryptocurrency markets, high liquidity is crucial for merchants, since it allows them to enter and leave quickly, reducing the risk of significant losses.

To achieve high liquidity, merchants use various strategies, including arrest detention orders, position size and market analysis. However, a popular method that has gained popularity in recent times is isolated margin trade.

The isolated margin implies the use of a specific asset as a guarantee for a part of the trade, which allows merchants to maintain control over their account while liquidity is still blocked. This approach offers several benefits, including reduced risk and greater flexibility.

For example, suppose a merchant wants to buy 100 units of Bitcoin (BTC) with 10 BTC lent. To minimize loss if the price falls, they can use isolated margin trade blocking their position using guarantees. In this scenario, the merchant would have to deposit the equivalent amount of BTC as a guarantee, while maintaining control over its initial investment.

Merchants who participate in cryptocurrency trade competitions also take advantage of liquidity and isolation to obtain an advantage. These events gather the best merchants around the world, offering a platform to show their skills and compete for the awards.

A remarkable example is the Cryptoslam tournament, which has been held annually since 2017. The competition presents several cryptocurrencies, including Bitcoin, Ethereum and Litecoin (LTC). Merchants must use isolated margin trade strategies to participate in the event without risking more than they can afford to lose.

Although the isolated margin trade offers significant benefits for merchants, it is essential to take into account that this approach comes with its own risks. For example, if the price decreases significantly, it is possible that the merchant cannot recover their losses, even if they have used the isolated margin trade.

In conclusion, liquidity and isolation are crucial aspects of cryptocurrency trade, offering investors a platform for rapid entry and exit strategies while minimizing the risk. As the market continues to evolve, we can expect to see greater innovation in this area, promoting growth and adoption among merchants.

Sources:

- “The impact of liquidity on cryptocurrency trade” by Coindesk

- “Isolated margin trade in cryptocurrency markets” by Cryptoslate

- “Cryptoslam tournament: a look at the best merchants in the world” of Cointelegraph